Solutions

Articles

Unlock your money, rent deposit-free.

You are eligible for our deposit-free service with properties from any landlord, agent, or rental platform.Get a quote

Landlords can list for

free

free

Discover the flexibility of listing any property type, on any rental range with Rently. Whether you have a cozy studio, family home, or even just a room, Rently makes it easy to connect with potential tenants!

Sign up now!Discover our featured properties

Our trusted partners in real estate

Adapted to your situation

Regardless of the context, our team adapts and finds a way to unlock your deposit money. We have dealt with a broad variety of cases and have helped finance $2 million worth of deposits.

Carlos Hernández“I want to get my deposit back from my landlord”

Carlos Hernández“I want to get my deposit back from my landlord” Tan Mei Ling“I found a property and want to rent deposit-free”

Tan Mei Ling“I found a property and want to rent deposit-free” Lim Sheng“I want to rent deposit-free and I have not found a property”

Lim Sheng“I want to rent deposit-free and I have not found a property”Frequently asked questions

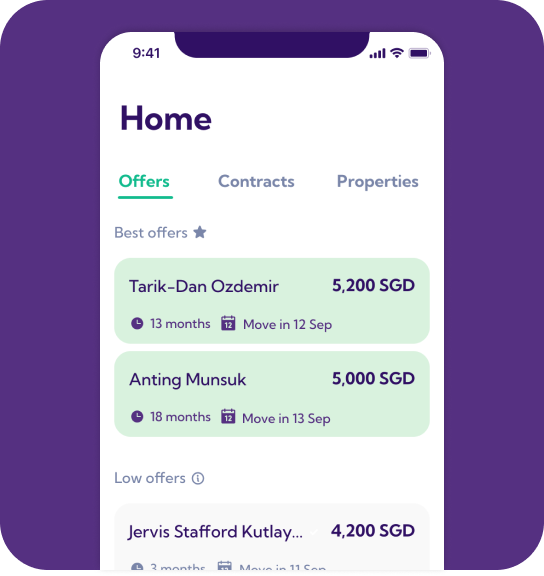

Rently is a Singapore-based PropTech startup that simplifies renting through a comprehensive platform for property listings, tenant acquisition, and contract management. Rently aims to create a secure and transparent marketplace, having integrated with Singpass for user verification.

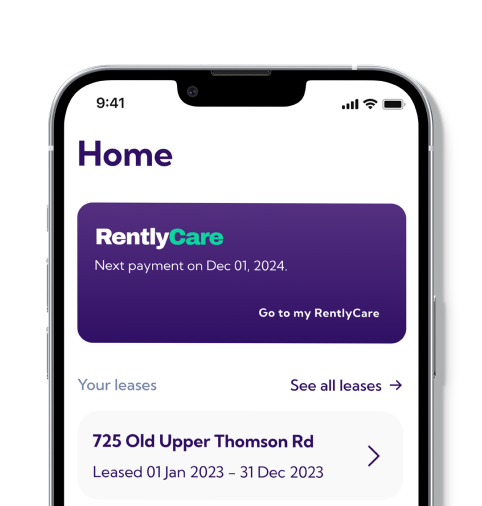

It also features a unique deposit-free renting service through its Rently Care subscription, which includes insurance, tenant vetting and dispute resolution.

Rently pays the security deposit to the landlord directly, while tenants pay Rently a monthly service fee as part of their service agreement. When the tenant moves out, Rently collects the deposit back from the landlord. This service comes at no fees for landlords.

Rently Care tenant applicants are approved only upon a full assessment, including tenancy agreement legitimacy checks, AML checks, and credit checks.

For a monthly service fee, tenants benefit in the following ways from Rently Care:

- Rently covers the security deposit for the tenant

- Access to our platform to log inventory defects, so that they have evidence of what the apartment was like when moving in

- Complimentary home contents insurance underwritten by Chubb

- Rently steps in when disputes arise between tenants and landlords

Landlords benefit in the following ways when allowing their tenants to use Rently Care:

- Complimentary home contents insurance underwritten by Chubb

- Tenant vetting including AML and credit score checks

- Timely security deposit payment by Rently

Landlords do not need to pay any fees at all to enjoy the benefits.As landlord, you can still claim any damages, and negotiations for deposit amounts still remain between the landlord and tenant.

Under Rently Care, Rently pays the security deposit directly to the landlord through bank transfer.

In order to facilitate this, landlords are required to onboard using Singpass (for identity verification), as well as to confirm their bank account details to ensure correct remittance of the funds.

In cases where an agreement cannot be reached between tenant and landlord on reasonable damages and standard wear and tear, Rently will step in as a mediator between both parties. With inventory images stored on our platform upon move-in, Rently takes an evidence-based approach in determining the reasonable extent of damages to safeguard parties against illegitmate claims and unfair withholdment of security deposits.

The landlord is held accountable based on the contractual terms laid out in both the tenant's tenancy agreement as well as the accepted terms by the landlord when onboarding with Rently.

In cases where the deposit is not paid out in full without reasonable claims and/or prior agreement with Rently, the landlord will be taken legal action against for breach of contract.

If it has been determined that unreasonable damage has been made on the landlord's property, the tenant will be responsible for reimbursing Rently for the deposit deducted.

Rently pays the security deposit to the landlord directly, while tenants pay Rently a monthly service fee as part of their service agreement. When the tenant moves out, Rently collects the deposit back from the landlord.

No, Rently Care is not a loan. Rently Care is a service that pays the security deposit required by landlords for the tenants. This is a facilitative service aimed at easing the initial financial burden for tenants when securing a lease.

Approvals are not guaranteed until applicants undergo a thorough evaluation inclusive of AML and credit checks.

Service fees are personalised depending on the applicant's profile and lease terms. An indicative estimate can be calculated on our Rently Care Calculator (https://rently.sg/rently-care-calculator), but a more accurate quote will only be given after a full evaluation based on your tenancy agreement and personal details.

Rently strives to make renting affordable and accessible to everyone, and our Rently Care service fees go as low as a basic gym membership's.

Rently aims to revolutionise the rental market in Singapore by offering more financially flexible ways to cover a tenant's security deposit, and Rently Care is based off a tried and tested model prevalent in many countries around the world, especially in the North America and Europe.

Yes, Rently Pte Ltd (UEN: 202206452W) is an ACRA-registered entity in Singapore with our office located in 100G Pasir Panjang Road, Interlocal Centre.

Rently is not an agent; Rently is a service provider with products like Rently Care. Rently Care covers the security deposit for tenants with other benefits, while also providing value to landlords who allow their tenants to do so. As part of the services provided, Rently steps in as a mediator when disputes concerning the security deposit arise.

No. A tenancy agreement is strictly between the tenant and the landlord. When subscribing to Rently Care, a separate service agreement will be drafted and signed with Rently.

Our complimentary insurance covers the following for tenants:

- Home contents damaged or lost by fire, floods, theft, and other defined events

- Alternative accommodation if the premise becomes uninhabitable from defined events

- Replacement of damaged locks or stolen keys in the event of a break-in

- Limited legal liability for damages as tenant in respect of the premises and any item while contained in the premises under the tenant's responsibility

- 24-hour home assistance for locksmiths, plumbers, electricians and other repair assistance required

The complimentary insurance covers the following for landlords:

- Home contents damaged or lost by fire, floods, theft, and other defined events

- Coverage of lost or damaged fixtures and fittings from defined events

- Coverage of rental income loss / furniture storage costs if premises becomes uninhabitable from defined events

- Limited legal liability from compensation in respect to accidental property damage occuring anywhere in the world

- Access to legal, tech and financial support in an event of identity theft

Enrolling in the insurance comes at no cost to tenants or landlords under Rently Care for a slew of benefits that aim to protect both parties. In addition to protecting your possessions from unexpected events, it also protects tenants from limited legal liability if made to pay for any damages subject to the policy terms and conditions. Should any issues occur with the premises during your tenancy, you will also receive 24-hour home assistance with referrals to locksmiths, plumbers, electricians and other general repair assistance necessary.

Upon approval of your application, Rently will pay the security deposit based on the stipulated deposit due date in your tenancy agreement or application details.

To apply for Rently Care, the minimum requirement is to have a signed tenancy agreement for an upcoming lease at the point of application. Depending on your profile, we may additionally require your latest bank statements to complete your evaluation.

To provide you with an accurate service fee quote, we will also require information related to yourself and your tenancy. To expedite the approval process, we strongly encourage applicants to supply this information over Singpass MyInfo.

MyInfo is a government database service that has transformed the verification process in Singapore.

It was launched in 2016 as an auto-filling tool for digital documents. MyInfo retrieval uses Singpass verification to allow you to consent and share the required data to participating businesses for a more seamless digital experience.

By using MyInfo, you can enjoy less form-filling and a reduced need for providing supporting documentation for verification. You may read more about it here: https://www.developer.tech.gov.sg/products/categories/digital-identity/myinfo/overview.html"

Rently approves LOIs on a case-by-case basis. Tenants may proceed to submit LOIs in their Rently Care application for consideration, but may require a longer processing time by our team.

Note that approved LOI applications are still required to submit the final, signed tenancy agreement for the service agreement to remain valid for the duration of the lease.

Rently's services are subject to approval based on numerous factors, including credit scores. As approval is not guaranteed, we strongly encourage applicants to have contingencies prepared in the event where Rently is unable to approve your application.

Not necessarily. To expedite your application process, we strongly encourage applicants to sign up with their Singpass Myinfo for the fastest verification checks, and apply for Rently Care with their signed tenancy agreement uploaded.

Rently's marketplace is one of many ways a tenant can find their dream rental apartment, and Rently Care is offered to applicants who have found an apartment from any platform, including those outside of Rently's.

As with any subscription service provider, late payments that breach the terms of contract will lead to termination of the service agreement, in which case Rently will recover the deposit from the landlord, and you as the tenant will pay the deposit. Legal action may also be taken in cases where we are not able to recover the deposit.

Note that late payments are subject to a late payment fee.

As of now, service fees are deducted the day the deposit is paid out to your landlord. We currently do not make provisions to deduct service fees on specific dates.

We are a digital signing partner with Singpass, a partner of the Real Estate Developers' Association of Singapore (REDAS), and collaborator with co-living and service apartment providers including Habyt, Far East Hospitality, Savills and Casa Mia.